Table of Content

Before you apply, it’s also helpful to understand the minimum requirements for getting a mortgage loan. These requirements will vary depending on your loan type. If you’re in the early stages of the home-buying process, prequalification can help you ballpark your budget. If you don’t prequalify for the loan amounts that you were hoping for, here are a few tips to afford more house. Getting prequalified is the earliest step in the home-buying process for many first-time buyers. When you prequalify for a home loan, you’re getting a general estimate of how much a lender will allow you to borrow.

When you’re shopping around for a home loan, it’s important to know what the tax rate is and how much of your monthly payment will go towards taxes. If you want to live in an area with high property taxes, you might find the value of the home you can afford is lower than if you were to consider buying in an area with lower taxes. With an income of $6,000, a mortgage payment of $1,600 and other debts totaling $1,300 per month, your debt-to-income ratio would be 48%. A preapproval is a stronger indication of mortgage approval, which builds your credibility as a serious buyer. Some sellers and agents won’t accept offers from buyers who are not preapproved because not having lender approval in hand can slow down your mortgage loan application. Keep in mind that a home’s purchase price isn’t the only thing that impacts affordability.

Keller Mortgage review: A national lender with preapproval

You’ll also get a lower mortgage rate if you have a very good or excellent score. When determining your eligibility, most lenders use your FICO score, which is pulled from each one of the three credit reporting agencies. FICO scores range from 300 to 850, and the closer you are to 850, the better your score. Scores above 800 are “excellent” or “exceptional” while scores between 740 and 799 are very good. If your score is in that range, it can be challenging to get any type of loan, let alone a mortgage. Now that you have a better understanding of the home loan application process, you may wish to go ahead and purchase the home of your dreams.

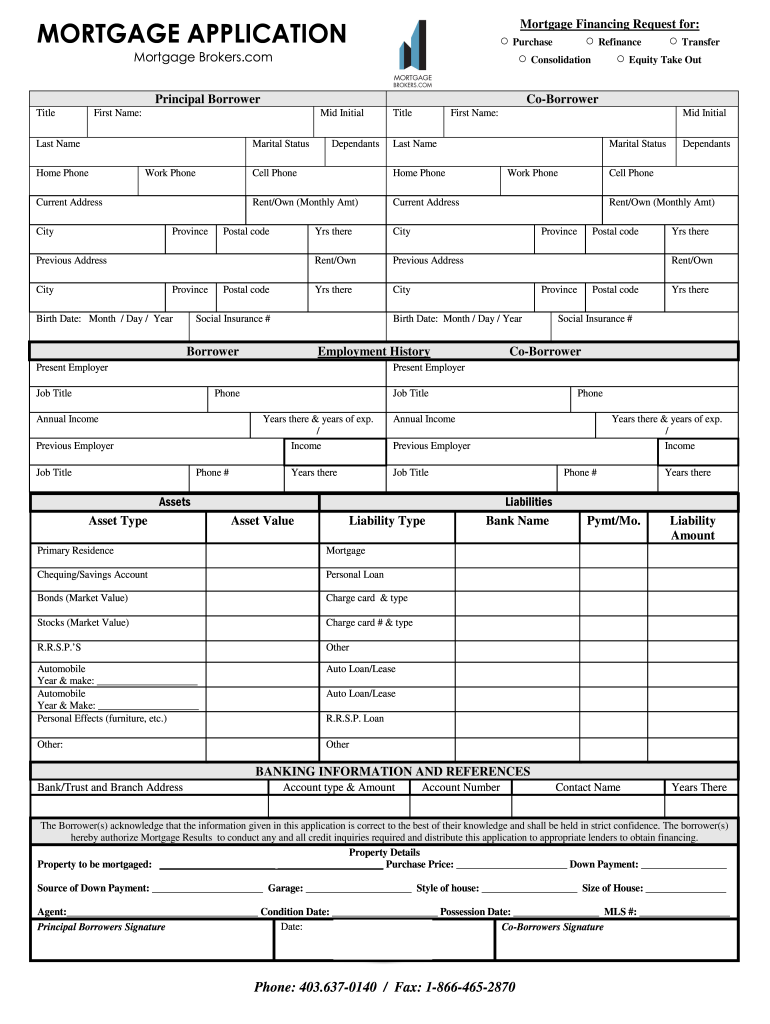

A home loan application can be a fairly simple and straightforward process. You don't necessarily have to supply a lot of documents – your lender can often pull those up for you. And you don't even have to spend a lot of time meeting with your lender or hanging around a bank – many lenders now allow you to apply for a home loan online. Uniform Residential Loan Application, with its five pages of questions regarding your finances, debts, assets, employment, the loan and the property.

What to Do Before Applying

Your lender’s goal is to assess you as a borrower and ensure you can make your payments on time. According to Bruce Ailion, a real estate agent in Atlanta, you may need to explain any blemishes on yourcredit report. Blemishes might include a previous short sale or a foreclosure. In order to assess you as a borrower, lenders often pull your credit report — with your verbal or written permission.

You don't have to post your down payment at the time you apply for a mortgage. That will be paid at closing, along with any other fees being paid up front. However, you will have to show that you can afford the down payment your loan requires. You will need to pay fees for such things as the property appraisal and credit report but these should be billed as part of the closing costs and not charged up front. It's also a good idea to obtain your FICO credit score from at least one of the three companies so you know where you stand.

The home loan application process in South Africa

Some lenders want to see the donor’s accounts for verification of the donor’s ability to gift, and some only want to see the funds being received in your account. And for further reference, here are specific rules for using gift funds as down payment. Debt payments and balances for credit cards, mortgages, student loans, car loans, alimony, child support, or any other fixed debt obligations. That proof is normally provided by your banking statements or other financial assets. If you are receiving down payment assistance from another person or from a public agency, you will need to show proof the funds will be provided to you.

You fill out an online mortgage application and submit your documentation electronically. Many of your documents may already be in electronic form; otherwise, you can simply scan them and submit them as PDFs. During the process, you can correspond directly with your loan officer by email or instant messaging to handle any questions you might have and guide you through the process. When you're ready to apply for a home loan, assemble your financial information and meet with your lender. Your lender can assist you in completing your mortgage loan application and will identify any additional information or documentation you need to provide.

Unlike preapproval letters, which are usually valid for up to 90 days, a prequalification should last indefinitely as long as your financial circumstances don’t change. However, if you’ve switched employers, lost your job, or maxed out any credit cards, you should apply for prequalification again. Some people get prequalified when casually looking at homes, or when they want a general idea of their future budget.

A mortgage is a loan used to purchase or maintain real estate. Lenders generally seek to loan to low-risk borrowers, so be ready to provide substantial proof of your finances. If you intend to sell your existing home before closing on the new home, you’ll need to provide a listing agreement for the home, and it will need to close before your new home can close.

That’s not to say there won’t be a number of other documents to sign and additional fees to pay, but home loan approval is really the ultimate objective. We provide a rundown of the home loan application process. As you get ready to apply for a mortgage, it can be helpful to pay attention to the time of the month. The end of the month is often the best time to close on a mortgage for lenders and borrowers. The property tax rate in your area and the value of your home will affect your monthly mortgage payment.

An appraisal isn’t a home inspection or a guaranty of value. Closing Disclosure, three business days before your scheduled closing date. Every statement you made on your mortgage application goes under the microscope in this stage. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Want to take cash out of your home equity to pay off debt, pay for school, or take care of other needs?

It’s an important measure used to determine whether you can repay the loan. The “qualified mortgage” rule recommends a DTI ratio at or below 43%. In addition to pay stubs and W-2s for the last two years, provide the company name, address and phone number for your current employer.

Once your offer is accepted, you’ll finalize your loan terms. Rates are still at historic lows, but are expected to gradually rise throughout the year. Get a mortgage rate lock to protect yourself against any upticks.

So, if you apply for a home mortgage in Texas by yourself, your spouse’s credit score is typically not at issue. Using together, however, means that both of your credit scores will be reviewed. Taking out a home equity line of credit instead of a home equity loan may be preferable if you want to have access to a revolving credit line rather than a lump sum. If you want to share financial responsibility for the HELOC with your spouse, it makes sense for both of you to be listed on the loan application. As with home equity loans, lenders will consider the credit histories, incomes, and debts of both spouses when making approval decisions.

No comments:

Post a Comment